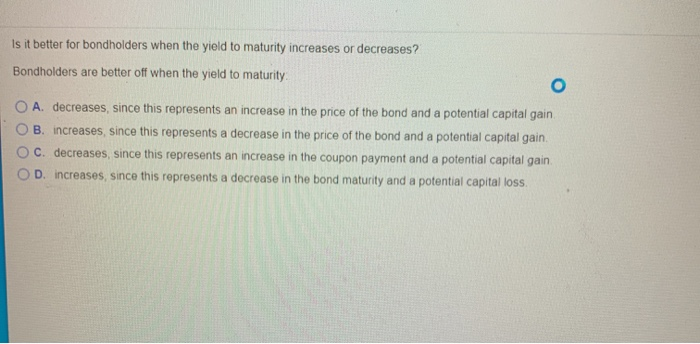

Is It Better For Bondholders When The Yield To Maturity Increases Or Decreases?

Who Has The Highest Psr Rating Ever 2022, 2K MOBILE IS 10x BETTER THAN NBA 2K22! (NEW PARKS), 11.63 MB, 08:28, 130,534, COLETHEMAN, 2021-12-17T00:57:12.000000Z, 19, Yamaha PSR-E373 keyboard review – TrendRadars, www.trendradars.com, 590 x 410, png, , 5, who-has-the-highest-psr-rating-ever-2022, KAMPION

So the year to maturity want to know is better for one though that's when the youth maturity is decreasing increases and the right answer would be decreases because where the mute majority decreases, it represents an increase in the price of the bond so it decreased in you to majority represents an increase in the price of the bond and also an. Is it better for bondholders when the yield to maturity increases or decreases? Bondholders are better off when the yield to maturity: Do bondholders fare better when the yield to maturity increases or when it decreases?

Increases, since this represents a decrease in the bond maturity and a decrease in potential capital losses. Decreases, since this represents an increase in the price of the bond and a decrease in potential capital losses. When the yield to maturity increases the coupon rate increases? If an investor purchases a bond at par or face value, the yield to maturity is equal to its coupon rate. If the investor purchases the bond at a discount, its yield to maturity will be higher than its coupon rate. A bond purchased at a premium will have a yield to maturity that is. Bondholders are better off when the yield to maturity: Decreases, since this represents an increase in the coupon payment and an increase in potential capital gains. Do bondholders fare better when the yield to maturity increases or when it decreases bondholders fare better when the yield to maturity?

Is it better for bondholders when the yield to maturity increases or

Solved: Is It Better For Bondholders When The Yield To Mat... | Chegg.com

Write down the formula that is used to calculate

a This is the case because the first payment due begins at a future

SOLVED:Would \ 175, to be received in exactly one…

Komentar

Posting Komentar